Why Cash Flow Is So Important For SMEs

Running a small business or medium sized enterprise (SME) is an immensely challenging but incredibly rewarding endeavor. You are required to constantly win new work, retain existing clients, deliver high quality results as well as defend against competitors.

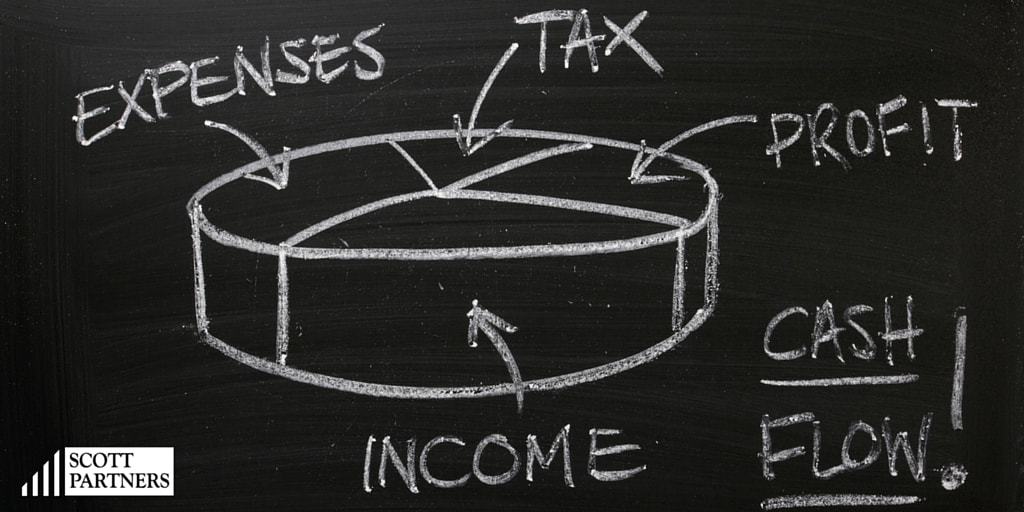

But when it comes to your business finances, there are really just two numbers that matter: money in the door, and money out the door. However, if we expand on this simple analysis, we can see the reasons why cash flow is so crucial, especially for SMEs.

Liquidity and efficiency

When there is cash in the bank, you have many more options. That means that you have the ability to pay bills as they become due. More importantly, you also have the means to take advantages of opportunities when they become available, before they expire or are taken up by someone else.

Having liquidity in your business can be compared to having cash in your wallet when you’re walking through a market. If you have no cash, there is no way that you can take advantage of the specials on offer, even if a vendor offers you 50%, 75% or even 90% off!

Banish the Time Thief

Cash flow management is one of the great thieves that steals productive time away from owners and managers of SMEs. Almost every manager can remember a situation of trying to “time” their bills with when invoices are received to ensure that the accounts were showing a positive number at all times.

The time you get back can be spent on much better pursuits, from winning new business, delivering better customer service, or even just having a well-earned coffee with your team!

Lose the Anchor

Debt is not a bad thing by itself, but the interest that accrues on debt can be crippling. Interest repayments to lenders act as an anchor on businesses of every size and shape. Even if you are generating plenty of spare cash, there is no sense lining the pockets of lenders with interest payments.

Paying down your debt reduces your interest payment, and excess cash flow as a fantastic way to use surplus funds. It might not be as exciting as buying a new piece of equipment or opening a new office, but it can increase your profits down the track by just as much.

To find out about how professional, timely advice can help you generate better cash flow and plan your business better, we invite you to call us here at Scott Partners to set an appointment at a time that suits you.