Tax Do’s and Dont’s For Small Businesses

While taxes may not be as exciting to think about, they are something every small business must endure. When it comes to filing your taxes as a business owner, there are some factors that need to be taken into consideration. Knowing which expenses are deductible and those that are non-deductible is essential. In some cases, the more money your business earns, the more money gets to stay in your pocket.

Here are some tax dos and don’t you need to be aware of.

Do’s

1. Keep track of your figures

As a business owner, you probably don’t have the time to know the numbers. However, knowing how your business is performing is important. Check on monthly figures, what came in and what went out to make comprehensive decisions regarding your business. It is crucial to know that even when you’ve outsourced an accounting company to submit your tax returns to the Australian Taxation Office, you’re still responsible for the figures.

2. Know what is deductible

Knowing which expenses are deductible is vital. Consult an accounting firm to know which expenses are deductible such as parking fees and motor vehicles.

3. Pay superannuation contributions on time

To avoid severe penalties, pay your superannuation contributions on time. Late payment attract a penalty and you could end up paying twice.

4. Talk to accounting and tax experts

Getting in touch with a tax expert is a must for every business owner. Australia has a complex tax regime and your accountant will help you navigate through the system to avoid penalties.

Don’ts

1. Trust Your Accounts to Spreadsheets

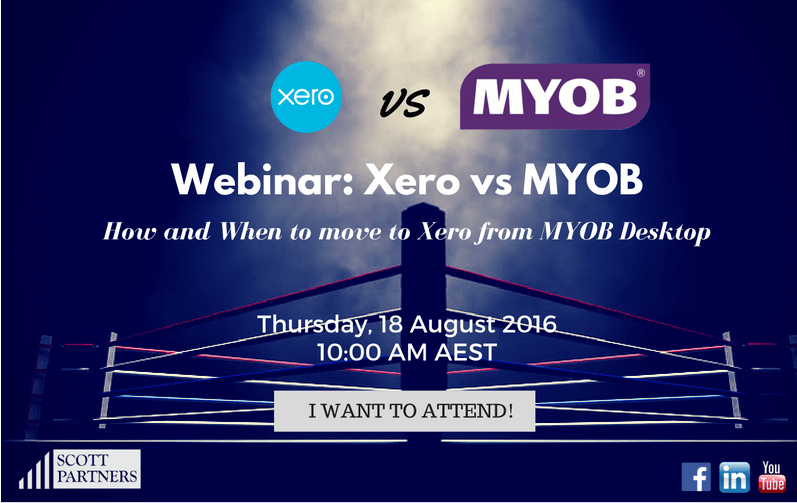

Gone are the days when you would have to use spreadsheets to calculate your assets and liabilities. Businesses are now shifting to a cloud-based accounting solution such as XERO. While most business owners think that their businesses are too small for that or that the program will be expensive, switching to a cloud-based program has numerous benefits.

One of the benefits is that you are able to have a clear, complete view of your numbers in real time. You can access this information on a mobile device, tablet or a desktop. Furthermore, you do not have to reconcile accounts manually, you can do this online on a cloud-based program.

2. Ignore GST

Knowing which expenses include GST is vital. GST costs can have a huge impact on your business. Check with your accountant to know which expenses are eligible.

To find out about other ways to improve your small business, give our friendly team at Scott Partners a call to schedule an appointment. We can give you professional, clear advice and help your business grow now and in the future.