New Tax Rates Coming

New tax rates coming (perhaps)

The Prime Minister has announced the currently legislated tax cuts, which are operational from 1 July 2024, will be changed. The idea behind these changes is to deliver to “middle Australia” help with the cost of living.

Some are of the view that these changes represent a broken promise. Certainly, until recently, the Prime Minister has continually said that the already legislated tax cuts would remain in place.

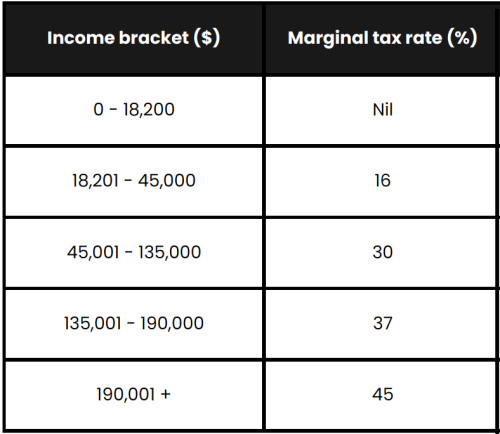

The new tax scales for resident individuals from 1 July 2024 will be:

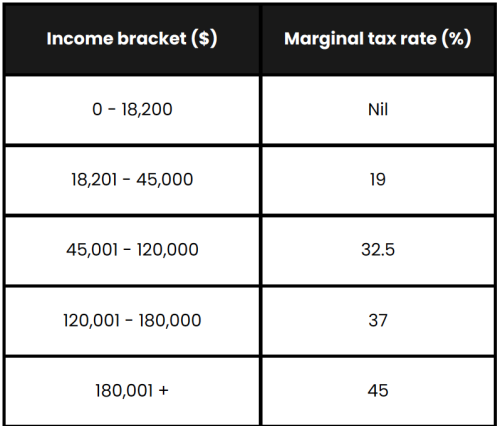

The current individual tax rates (year ending 30 June 2024) are:

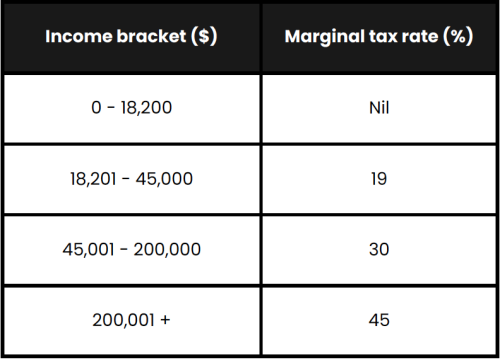

The currently legislated tax rates that would have been applicable from 1 July 2024 – whichare now proposed to be repealed are:

The proposals must, of course, be passed by both houses of parliament before they become law. It has been reported that the Greens are seeking to have the tax-free threshold raised. If this were to be the case, it can be expected that those on higher incomes will probably

finish up footing the bill for this. So, at the time of writing it is not known whether the Albanese Government’s proposal will be enacted as proposed.

“Bracket creep” remains the silent mechanism that increases taxes for individuals in Australia. This refers to the effect (mainly) of inflation on the taxable incomes of individuals. As their income rises, they are more likely to be pushed into a higher tax bracket. Over time, this provides for an unlegislated ability for the federal government to collect more tax. This issue could simply be fixed by indexing the tax thresholds for inflation. No government has ever proposed this idea.